We are at the end of our summer garden and it did not do well this year. It is a lesson for me that here at our house, a summer garden is too difficult. We fight the heat and mosquitoes and the harvest has been poor for a couple of years now, but gardening is not over.

.jpg)

This was my first year planting potato onions and I ended up doubling what I planted so that is a good thing. It seems to be difficult to grow onions of any kind here where I live but I keep trying.

I have decided to garden in cooler weather and last years test winter garden did surprisingly well. I do not see many winter gardeners here but I feel we might need to change that. I have planted new seeds for fall and so I will see what happens with this years fall garden.

We have pulled many of the spent vegetable plants and I need to add some new compost to this tank.

This is another tank that is getting ready for a new planting. What was actually in here was lemon balm that had taken over the tank. Charles transplanted the lemon balm to it's own large container.

I was looking back at some of my photo's and realized that there are many things I do in the same months. Just this week told Charles that I needed to polish the silver and I saw this in last years photos at the same time it is now.

I mentioned to Charles this week that I need to go back to making yogurt again and this time last year I was making yogurt.

I had not mentioned to Charles that we need to clean the windows but now that I looked at last years photos, it is time to clean the windows! :)

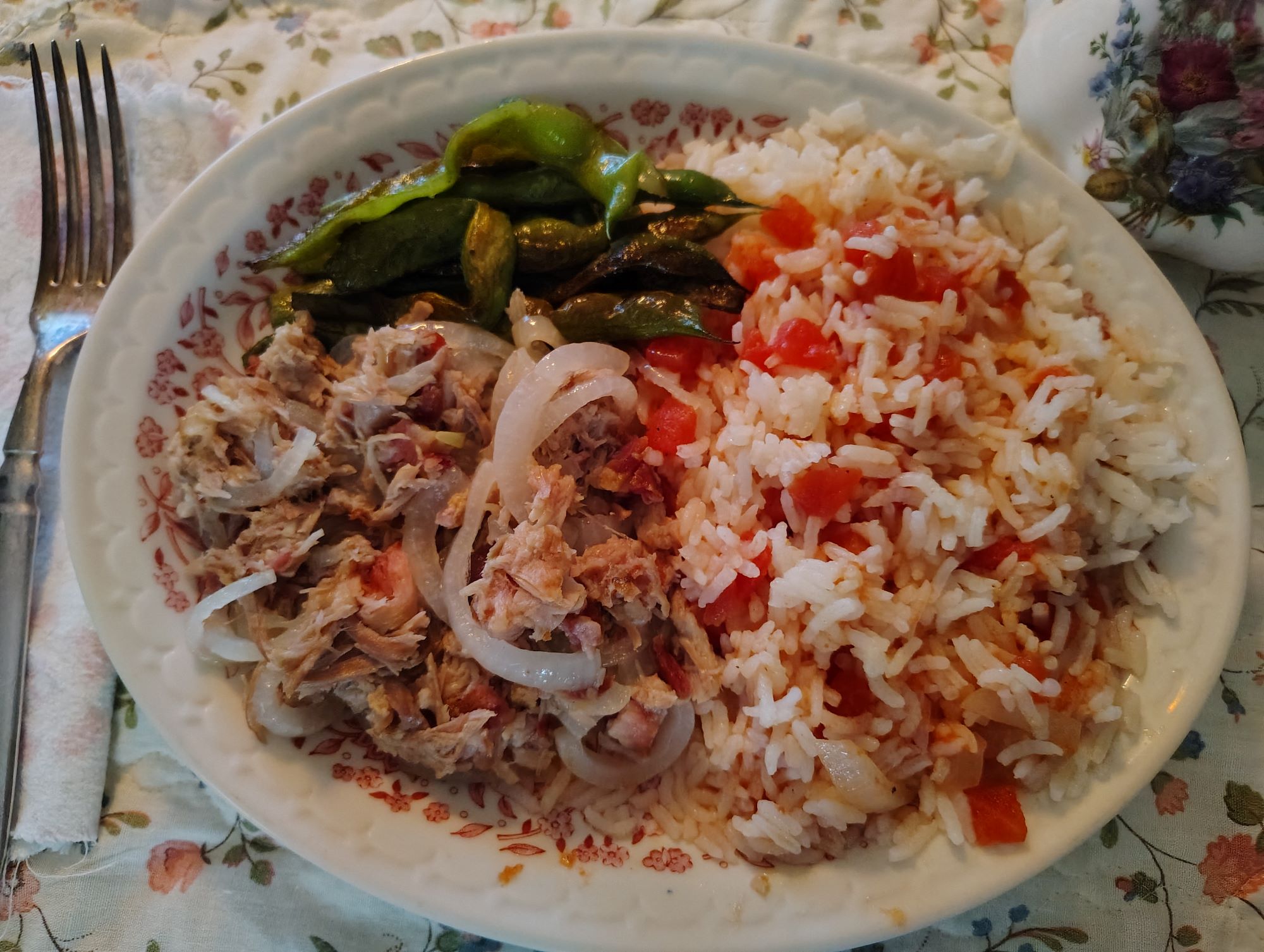

The day I am typing this, it is August 22 and we still have $155.23 left in our $400.00 per month food budget. Remember that we do not eat out at all and our only food source is what we make from home. I feel that we will have budget money leftover to go into the grocery savings fund.

We made a batch of quesadillas with beans and cheese. We make our own fresh tortillas and is a big savings compared to the price of a package of a good brand.

.jpg)

Just a few of our meals this week.

I was dusting this morning and I thought how much of a relief to be finished with the budget. I turned every bill that we have and every future thing I could think of and turned each one of them into a fund.

I started a new budget book so to be ready for Charles retirement and so we can flow into it from him working a job to a fixed income.

Each bill has a Budgeted amount so that it will carry over something to save. If a bill is $84.00 that item on the bill will be $90.00. Each time we pay that bill $6.00 will be left in the fund. the next month another $6.00 so then the total will be $12.00 and so in twelve months that will be $72.00.

I have set a budget amount for electricity higher than what we want the bill to be so we do our best to keep our electric down below the budgeted amount so we will be under budget and any money left is savings.

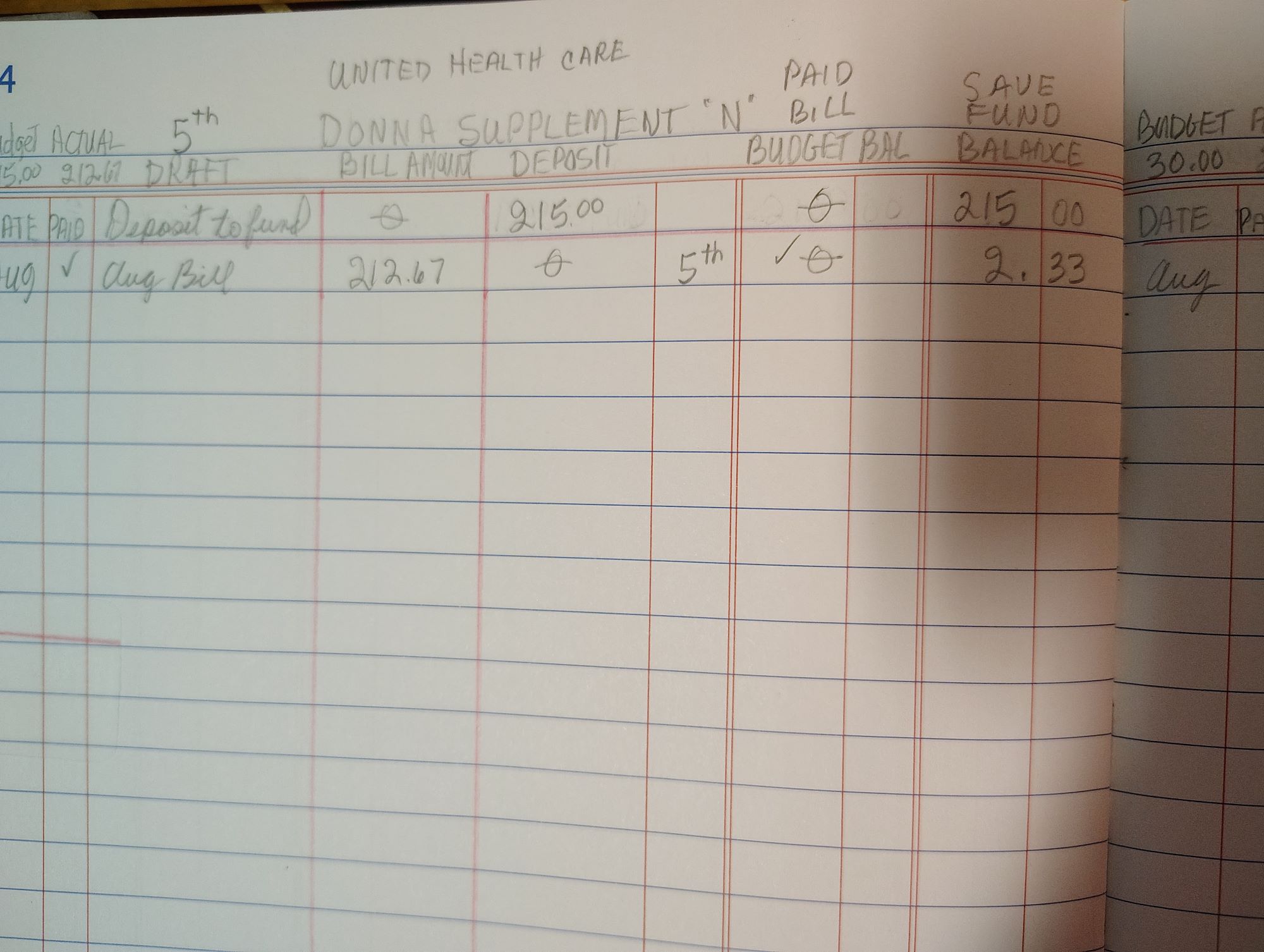

That $2.33 is the amount over the actual bill. This bill is $212.67 per month. The budget is $215.00 so there is a $2.33 difference. So, $2.33 x 12 months = $27.00

It does not sound like much but if each bill has a bit extra, that does end up being a lot.

This is the budget for Doctor Co-pays. I had $70.00 built up in that fund. The budget amount is 10.00 so I added the monthly 10.00 so there is always money going to that fund as I go to the doctor I can use that money for my $20.00 co-pay each time I see a doctor. The months I do not go to a doctor that keeps adding $10.00 to the fund. I try and stay out of a doctor office.

We have a Emergency room co-pay fund and also a Emergency Fund.

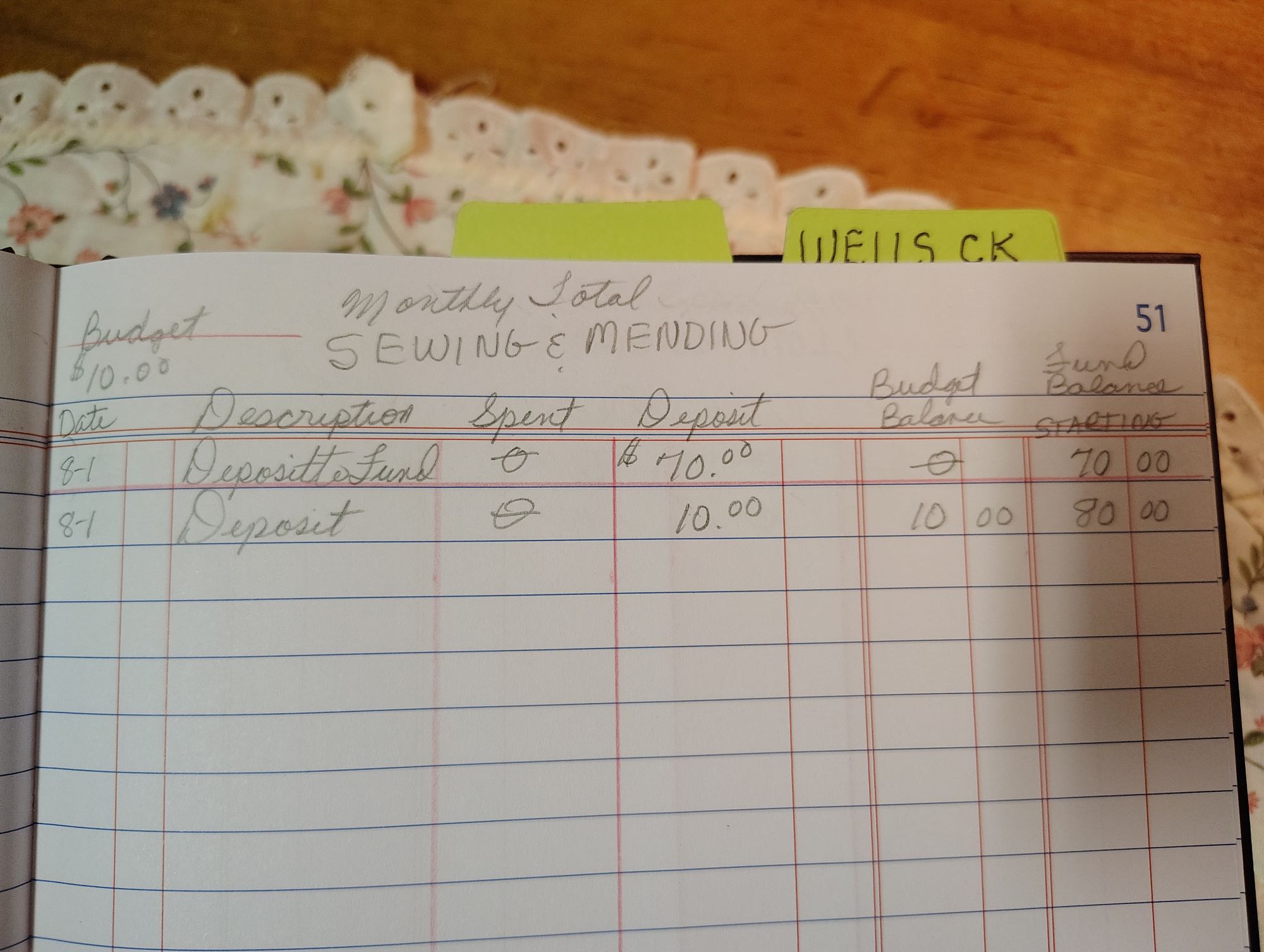

I also have a different kind of fund besides bills and this is a budgeted savings fund for everything from Groceries, dog food, cat food, postage stamps, house repairs to sewing and mending and this is the sewing and mending fund.

Again, I started new books and carried over my saving balances into the new book. This is a $10.00 per month payment to my sewing and mending fund and when I added my $10.00 to that fund it became $80.00. This makes me very careful about what I want or mainly "need" before I will spend on Sewing and Mending. Best to use up what I have or use other things and re-purpose.

.jpg)

My Grocery ledger

I record every single grocery item in this ledger. I enter the amount at the end of the month in the main book. This is one of the few things that I do not add a buffer so I am very careful to stay under budget.

By having our $400.00 budget some will say that is not enough and some will say that is too much. I try to stay under and carry over what is left to my food saving book for food during holiday. I also have a guest food budget so if someone comes to visit I use that money. I have a cat food budget, a dog food budget and a cat litter budget. This forces me to look for when litter goes on sale. When we open a bag of food we write the date and this is how we learned how much we need. We also measure the girls food and when they get something extra it is what we make them from real food.

My main ledger, I have made a calendar of important dates, a monthly expense tracker, there is an index to find pages. There is a running balance of each fund and I made the book to last one year.

.jpg)

Elizabeth zoning out in her lookout window that has slobber and nose marks all over it.

When Charles and I set a retirement date we did not realize that we would need three months of pay to get this budget started off in the right direction.

I am no expert at anything but this is how it has been for us and how I have personally budgeted.

When we set the date for retirement, got through with contacting social security we knew that the first month we would not get a social security check because they told us that and we also knew this because I retired before Charles. But Charles was still working and I had quit work early to be a caregiver for my parents so my social security was helpful after several years of not working.

But then we realized that the month without pay was not the only thing to consider, both of our social security checks would not come in until the second and third week of the next month.

That meant that there would be no pay the first month bills and since many of the bills come in the first part of the month we needed money for that second month to pay bills and needed another month so that we could get one month ahead. That was a lot of money.

We had been practicing for social security for quite awhile now so we saved up what we thought that we needed but that third month came as a surprise.

The savings extras from the budget helped us to have that third savings. So what I am saying is that if you are planning on retiring make sure to save up enough to cover your bills and food and expenses for three months. This has nothing to do with your retirement savings. You do not have to have that third savings but it would greatly help. There are going to be things that we do not think of until we start living on social security.

We are going to try our best to live on social security only and not use our savings unless it is for something such as an emergency or planned repair.

Funeral cookies, I will put a link to where I first learned about funeral cookies.

Another thing to consider in retirement, and that is death. When one spouse dies part of the social security payment will stop. I receive less social security than Charles and he will lose my social security check when I die and my check is helping to pay bills. If Charles dies, I will lose my check and get his check but still that is a loss of my check.

We must prepare for this so to be able to retire without struggling all along the way we need savings, we need to think ahead and we need a detailed budget and a way to save for losses.

Many people do not think about this before they go into retirement and why I am bringing this up.

In my budget I figured in death and what would drop off of the bills when either of us dies. Say I die first, my supplemental insurance expenses, my co-pays, my first of the year deductible would not be needed. My medications would stop, groceries would decrease some, one cell phone would no longer be needed and such as this. But at least for us, there will still be a loss of money and so we need savings for the other to be able to manage. All I can say is think forward of what is needed and not needed to be as prepared as possible for retirement.

Some people might need to move to a smaller home, with less upkeep. We already live in a smaller home. If there are two cars, possibly sell the other car, that will drop car insurance and tags and servicing. People like to hold on to things that belonged to the other and that is okay as long as you can manage , but if it is costing money to keep it and you need the money to live this is a consideration. We budgeted the lake house expenses into our budget and as long as we can manage then that would be something to sell if we need to. We might do that anyway but as I said in another blog we will wait until Charles retires soon and make that decision after we start living on social security.

I like to watch Buzz Retirement Garage on youtube. Buzz retired and he and his wife are trying to live off of social security and show how they have to adjust things to not go over the budget. Each end of the month or the first of the month Buzz has a marker board and he shows if they stayed in the budget or went over.

I hope this helps in some way, no matter how young you are, you should be thinking now of saving for retirement so you are prepared, it will come faster than you realize.

If you are retired did you have any surprise expenses?

Are you still too young to retire but are already planning?

What are you doing to get ready for a season change at your house?

Do you have any seasonal cleaning and repairs that you do?

Hope to see you up in the forum to discuss this.

Here is the link to the Youtube channel that shows Justine from Early American making funeral cookies.

https://www.youtube.com/watch?v=_EUngyoImIc&t=1s

Those of you still suffering from the heat, cool weather will be coming soon (I hope).

For those of you still in winter, warm weather coming your way possibly before you are ready for it. Let your summer be warm not hot. :)

Grandma Donna

.jpg)